Michigan Monthly Market Report - July 2013

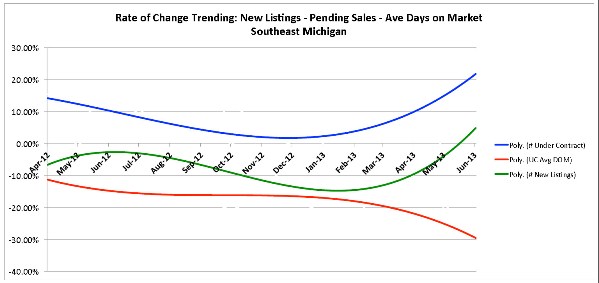

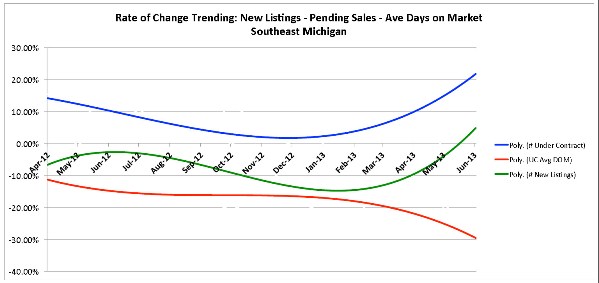

Buyer demand in June continued at a strong pace in terms of new purchase contracts written (pending sales). June also continued the trend of more sellers putting their homes on the market, which should “in theory” relieve some of the significant inventory shortages. We say “in theory” because although new listings did rise, so did buyer demand, quickly absorbing the additional homes. In spite of more homes coming on the market, the available inventory continues to fall, reaching a new low for Southeast Michigan of 2.1 months (1.5 months for homes on the market less than 90 days). As we have shown over the last few months, the rate of growth for both new sales and listings continue their upward movement resulting in fewer days on market.

Enlarged View: Annual Appreciation Graph

Enlarged View: Annual Appreciation Graph

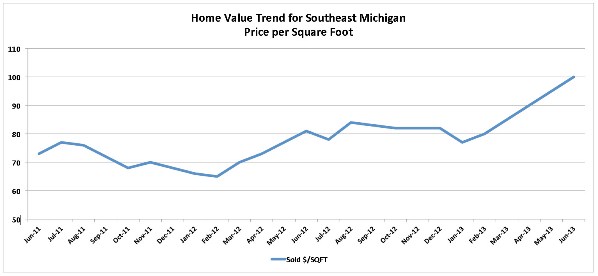

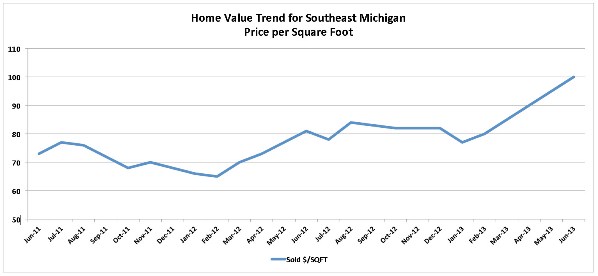

It is not surprising that the home value trend continues to accelerate, as well.

Enlarged View: Price per Square Foot Graph

Enlarged View: Price per Square Foot Graph

Interest rates were the biggest news in the past 30 days, rising in anticipation of the federal government rolling back their support of low mortgage rates. Showing appointments slowed a bit in June, which might indicate a reaction to the rising rates. So how high will rates move? Since jumbo mortgage loans (loans over $417,000) do not have a federal subsidy, they are the best gage of where interest rates should move. Right now both conventional and jumbo rates are nearly identical, meaning they have moved to their true market level and we can expect them to remain stable in the short run. However, as the economy continues to improve, rates will rise.

What is the “cost” of waiting in the current market? For buyers the math is pretty easy. If values go up 10% and interest rates rise 1%, their buying power is reduced by 20% (i.e mortgage payments increase 20%), which is of course why so many buyers are attempting to buy now. For Sellers, that 1% rise in rates will negate a 10% increase in value. Therefore, over the next few years rising rates will offset some of the rising appreciation, reducing buyer demand and limiting the amount of wild cash offers given to sellers.

Buyers should be aware that in more and more cases, sellers are requiring the buyer to commit to covering some or all of the short fall if the appraisal comes in lower than the agreed purchase price. Prices have not yet reached their 2005 peak levels so overbidding is still a safe bet to get the home you really want, even if the appraisal comes in lower. Appraisers have a very difficult time catching up with a rising market, since they rely on historical sales data to determine the value of a property.

What is the “cost” of waiting in the current market? For buyers the math is pretty easy. If values go up 10% and interest rates rise 1%, their buying power is reduced by 20% (i.e mortgage payments increase 20%), which is of course why so many buyers are attempting to buy now. For Sellers, that 1% rise in rates will negate a 10% increase in value. Therefore, over the next few years rising rates will offset some of the rising appreciation, reducing buyer demand and limiting the amount of wild cash offers given to sellers.

Buyers should be aware that in more and more cases, sellers are requiring the buyer to commit to covering some or all of the short fall if the appraisal comes in lower than the agreed purchase price. Prices have not yet reached their 2005 peak levels so overbidding is still a safe bet to get the home you really want, even if the appraisal comes in lower. Appraisers have a very difficult time catching up with a rising market, since they rely on historical sales data to determine the value of a property.

Morris Hagerman is a local real estate agent with Real Estate One in Royal Oak, Michigan. He serves Berkley and the other Woodward 5 communities, including Ferndale, Pleasant Ridge, Royal Oak and Huntington Woods. Hagerman is also a member of the Berkley/Huntington Woods Area Chamber of Commerce. You can contact him by phone at 248-854-8440, email at morrishagermanproperties@gmail.com or visit his web page.

No comments:

Post a Comment